The clock is ticking: Secure New York City’s 35-year tax abatement before it’s too late - by Robert Khodadadian

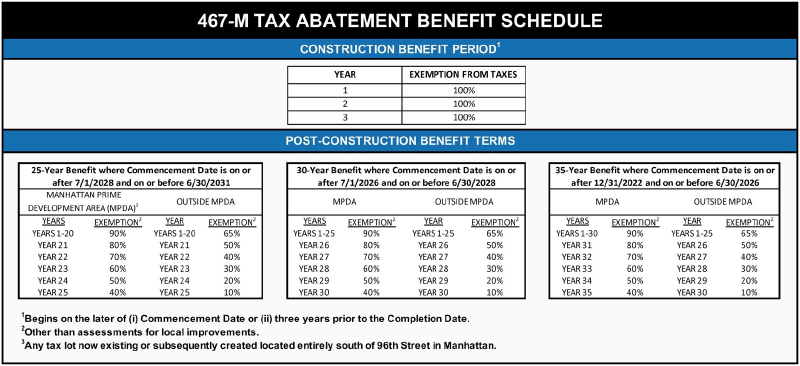

If you’re considering converting your office property to residential use, the window to take advantage of one of New York City’s most valuable real estate incentives is closing fast. The 35-year real estate tax abatement under Program 467-m offers a major financial opportunity — but only if your project is approved by June 2026. To put it plainly: a delay could cost you millions.

This long-term tax abatement was designed to encourage the conversion of underutilized commercial buildings into much-needed housing. For owners and investors, it can mean a significant boost in property value and long-term returns. But the opportunity comes with a strict timeline — and it’s already narrowing.

The Real Timeline: Plan Backwards from June 2026

To qualify, you must hit several critical milestones before the deadline:

• ALTCO Filing (6–9 months): Filing the Application for Tax Credit for Office-to-Residential Conversion is a complex process that can take up to nine months.

• Planning & Approval (3–4 months): Finalizing architectural plans, ensuring zoning compliance, and obtaining permits also requires time and coordination.

• Sales Contracts (9–12 months before): To fully realize the abatement’s benefits and maximize your property’s value, contracts should ideally be signed at least a year before the June 2026 deadline.

In short: if you want to qualify, you need to begin planning now — ideally no later than mid-2025.

The Cost of Waiting

Missing the deadline could reduce your abatement by five full years — a loss that can significantly impact your property’s valuation. Today’s buyers use Net Present Value (NPV) models that factor in long-term tax savings. Without those five years, your asset could be perceived as less attractive, leading to a lower sale price.

To illustrate the financial impact, here’s a hypothetical breakdown of projected tax savings over time based on current market assumptions (see chart above):

As the figures suggest, missing out on the full 35-year abatement can result in millions of dollars in lost net present value. These unrealized savings directly affect your property’s appraised value — especially as buyers become more sophisticated in their financial modeling.

In a recent deal we facilitated, a property that secured the full abatement sold for 20% more than a comparable building that missed the deadline. Timing made all the difference.

How to Get Started

Navigating an office-to-residential conversion in NYC requires careful planning and expert guidance. Here’s how to move forward strategically:

1. Assess Your Property: Work with experienced professionals to evaluate zoning, infrastructure, and overall financial viability.

2. Engage ALTCO Specialists: Experts in the filing process can streamline your application and help avoid costly delays.

3. Create a Clear Timeline: Develop a detailed roadmap with milestones to keep your project on track.

4. Communicate with Stakeholders: Keep architects, city agencies, legal advisors, and financial teams aligned throughout the process.

Why This Matters Now

NYC’s real estate market is evolving rapidly. Residential demand is rising up 15% year over year in many neighborhoods. Office-to-residential conversions are helping meet this need while offering property owners a smart, future-focused investment path.

The 35-year tax abatement makes these projects significantly more attractive — but only if you act in time.

Let’s Talk

At Skyline Properties, we specialize in identifying and executing smart, timely investment strategies. If you’re considering an office-to-residential conversion, now is the time to align your team, solidify your plan, and move forward with confidence.

Don’t let this opportunity pass. The June 2026 deadline is approaching — let’s make sure you’re ahead of it.

Robert Khodadadian is president & CEO of Skyline Properties, Manhattan, N.Y.

Meridian Capital Group arranges 10-year retail lease for Mess at 236 West 10th St.

Lasting effects of eminent domain on commercial development - by Sebastian Jablonski

Behind the post: Why reels, stories, and shorts work for CRE (and how to use them) - by Kimberly Zar Bloorian

Strategic pause - by Shallini Mehra and Chirag Doshi

.jpg)

.gif)

.gif)