JLL arranges $231 million financing for industrial outdoor storage portfolio

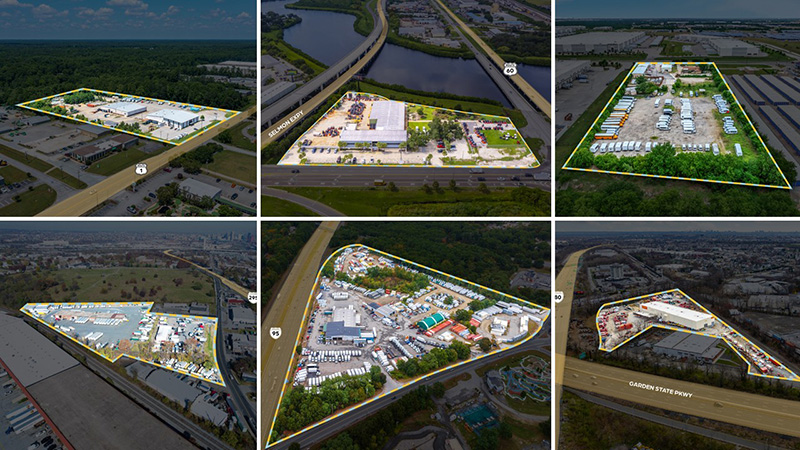

New York, NY JLL Capital Markets arranged $231 million in financing for a 43-property industrial outdoor storage (IOS) portfolio totalling 293 acres across 13 states.

JLL worked on behalf of JIOS to secure the loan through Blackstone Real Estate Debt Strategies. JIOS is a vertically integrated real estate company owned and institutionally supported by Jadian Capital.

The 43-property portfolio features IOS facilities with tenants including United Rentals, Waste Management, Ryder, ABF Freight and the largest national e-commerce provider.

The portfolio spans 19 markets across 13 states, with 54% of acreage concentrated in Sunbelt states and 37% in Northeast and Mid-Atlantic regions. The properties are situated near major metropolitan areas and key logistics infrastructure, benefiting from proximity to seaports, rail systems, highways and airports. This positioning allows the assets to capitalize on regional economic strengths while providing critical last-mile and distribution capabilities in key logistics markets.

“We’ve been investing in IOS for many years because of the sector’s large demand tailwinds and durable supply barriers. This financing underscores how institutional lenders have come to appreciate these same traits,” said Dan Schuchinsky, managing director at Jadian Capital. “Our team and portfolio span the country, and with our discretionary capital and lender support, we plan to invest ~$2 billion in IOS over the next two years.”

The JLL Capital Markets Advisory team was led by senior managing director Peter Rotchford, managing director Tyler Peck and senior managing director Christopher Peck.

“The portfolio’s high-quality tenant roster, strategic infill locations and compelling supply-demand fundamentals made it a very attractive financing opportunity,” said Peck. “We’re seeing sustained interest in the IOS sector as investors and lenders seek to capitalize on the evolving needs of e-commerce, logistics and last-mile distribution users.”

Meridian Capital Group arranges 10-year retail lease for Mess at 236 West 10th St.

Strategic pause - by Shallini Mehra and Chirag Doshi

Behind the post: Why reels, stories, and shorts work for CRE (and how to use them) - by Kimberly Zar Bloorian

Lasting effects of eminent domain on commercial development - by Sebastian Jablonski

.jpg)

.gif)

.gif)