Do you need to be worried about

this next wave of tariffs? - by Kerrick Wille

Ahhh… August. A time for barbecues, ballgames, and beers by the pool. The relaxed pace of summer couldn’t come soon enough for real estate professionals after a year of hard-earned progress. But hold on — this August is shaping up to be anything but relaxing. Just as the real estate and construction sectors began to feel a sense of stability regarding tariffs and pricing, a new wave of tariff hikes is set to take effect. These changes threaten to reignite the uncertainty developers, lenders, and contractors had hoped was behind us. Alongside other evolving trade policies, the new tariffs raise pressing questions about cost volatility and construction material availability. Let’s walk through what’s changing and how it could affect your bottom line.

Where will key tariffs be by the end of the summer?

China 145% (currently at 30%)

The current reduction of China tariffs will return back to 145% after nearly three months of sitting at 30%. This move has the potential to be a major disruptor for real estate developers, lenders, and contractors alike. If you have grown accustomed to pricing based on the 30% tariffs that have been in effect since May, then you will certainly have to adjust.

Canada 35% (currently at 25%); Mexico 30% (currently at 25%)

From the north, USMCA-compliant goods are generally exempt from the 35% tariff, including Canadian lumber (which faces a separate tariff of 14.54%). Still, the 10% tariff on most Canadian goods will most likely increase prices as a whole and it will be felt in the industry. From the south, Mexico appears eager to make a deal which is good considering over $80 billion in construction materials were imported into the US in 2024.

Copper 50% (currently at 0%); Steel and Aluminum 50% (increased from 25% on June 4th)

The 50% tariff on copper is being introduced after copper was untouched by tariffs for the entirety of 2025 so far. This new change will most definitely be felt in pricing for wires, pipes, and HVAC components.

Reciprocal tariff suspension ends; EU 30% (currently at 10%)

The reciprocal tariff act was paused all the way back on April 9th, and after being extended past its original 90-day life cycle, it is set to resume on August 1st. This will increase tariffs for many countries from the current universal 10% tariff to anywhere from 11-50%. Notable increases include Japan (25%), South Korea (25%), and the EU (50%).

What has the construction material impact been so far?

Interestingly, price spikes have not been as steep as originally feared — at least not yet. Many general contractors and site supers are reluctant to raise prices too quickly. In a volatile market, they’d rather secure work with tighter margins than risk losing bids. That said, some domestic suppliers have already increased prices, and this trend is expected to continue as international pricing pressures mount. Ironically, domestic price hikes won’t show up in tariff statistics — even though they affect your budget — because the materials originate within U.S. borders.

So, what does this actually mean for my construction cost bottom line?

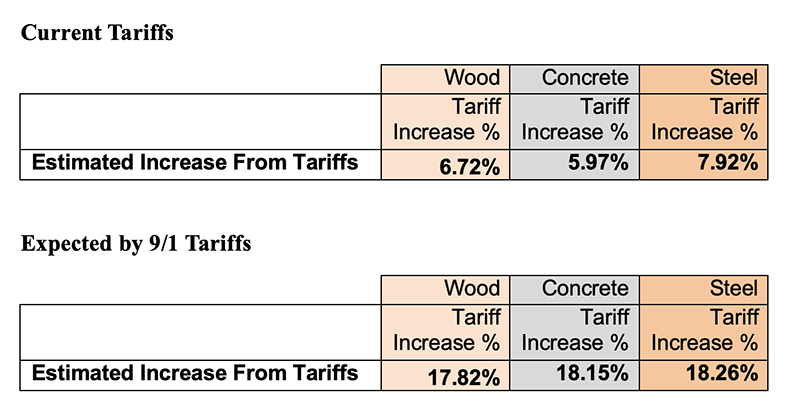

We’ve modeled the potential cost impact of these tariffs across three building types: wood-framed, concrete, and steel structures. In the graphic is a breakdown of the estimated tariff-driven percentage increases by trade.

Conclusion

To date, the impact of tariffs has been less catastrophic than many anticipated — but the risk and uncertainty landscape is shifting again. As long as these new tariffs remain in flux, so will pricing confidence in the real estate and construction sectors. For now, stay informed, stay agile — and if you can, still find time to enjoy a cold drink by the pool this August. You’ve earned it.

Kerrick Wille, is a building consultant at KOW Building Consultants, Manhattan, N.Y.

NYC mayor and DOB release comprehensive façade inspection and safety study conducted by Thornton Tomasetti

.gif)

.jpg)

.gif)