Qualified Opportunity Zones: Where are they now? - by Sandy Klein

Qualified Opportunity Zones (QOZs) – the quirky U.S. census tracts that can facilitate tax-free gains on qualified investments monetized after a 10-year holding period – are up against expiring deadlines. As with other popular-but-temporary provisions of the 2017 Tax Cuts and Jobs Act (TCJA), many are wondering what’s next. Key questions include the final dates for qualified investments, considerations as deferred capital gains taxation approaches in 2026, and potential changes under upcoming tax reform.

What Is the Latest Date a Qualified Investment in a QOZ Can Be Made Under Current Law?

To be eligible for the unique tax benefits associated with making a QOZ investment, on or before Dec. 31, 2026, a taxpayer must first realize eligible capital gain on a sale to an unrelated party. The taxpayer then has 180 days – potentially from three different starting points, depending on whether the gains were realized directly or indirectly (see below) – to invest cash equity into an entity designated as a Qualified Opportunity Fund (QOF). If all qualifications are met, the taxpayer’s realized gain on the original asset disposition is deferred until Dec. 31, 2026, and new gains attributable to the QOZ investment are tax-free if sold after a 10-year holding period. Importantly:

Eligible capital gains realized by a taxpayer directly (e.g., brokerage gains reported on a 1099 or capital gains from selling other 100%-owned assets such as if owned through a disregarded entity) can only be invested for QOZ tax benefits within 180 days of the realization date (sale date plus 179 days).

For eligible capital gains realized by a taxpayer indirectly (e.g., reported on Schedule K-1 from a partnership, S-corporation, estate, or non-grantor trust), the taxpayer has three 180-day timeframes to make an investment for QOZ tax benefits:

Within 180 days of the date the asset was sold by the issuer of the Schedule K-1 (sale date plus 179 days);

Within 180 days of the tax year end of the issuer of the Schedule K-1 (Dec. 31 of year sold plus 179 days); or

Within 180 days of the extension due date for the issuer of the Schedule K-1 (March 15 following the year sold plus 179 days, if a partnership or S-corporation; April 15 following the year sold plus 179 days, if an estate or non-grantor trust).

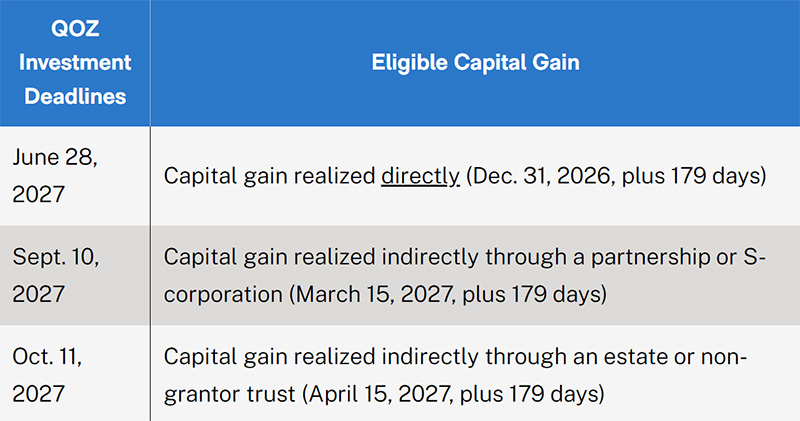

This means if a taxpayer realizes eligible capital gain on the last day of 2026 – the latest date eligible capital gain can be generated under current law to be eligible for reinvestment for QOZ tax benefits – the latest date(s) a QOZ investment can be made is as follows*:

Note: All dates assume the issuer of the Schedule K-1 files its tax return on a calendar year end rather than a fiscal year end.

If eligible capital gain is realized during 2026 but not on the last day of the year, only if realized directly would the reinvestment deadline be sooner than is what is referenced immediately above. This is because only with directly realized gains is the 180-day reinvestment window solely tied to the realization date (sale date plus 179 days).

What Should Be Considered as the Taxation of Previously Deferred Capital Gains Approaches in 2026?

General – For taxpayers with previously deferred capital gains due to investing in a QOF, these will become taxable on Dec. 31, 2026 (assuming not already recognized due to an earlier inclusion event). Planning to have sufficient liquidity to pay this tax liability is critical, as most underlying QOZ businesses will likely be unable to generate sufficient cash flow to distribute to investors at that time to help pay the tax. By virtue of being taxable in 2026, the tax associated with the recognition of deferred gains will ultimately be due by April 15, 2027, but depending on the taxpayer’s fact pattern, making earlier estimated tax payments during 2026 may be appropriate.

To calculate the deferred tax obligation, it’s important to note that the deferred gains’ original character is retained (e.g., short-term capital gain, long-term capital gain, or Section 1231 gain) and taxed as such based on applicable tax rates for the 2026 tax year. Further, depending on the investor’s fact pattern, state tax and the Federal net investment income tax might also apply. With taxes on deferred gains coming due soon, affected taxpayers should be aware of the magnitude and have a liquidity plan to ensure they can be paid.

Basis adjustments – If a QOF investor achieves a five-year holding period in their QOF investment by Dec. 31, 2026, 10% of the previously deferred capital gain associated with the investment will never be taxed, due to realizing a tax-free step-up in the tax basis of their QOF investment once the five-year holding period is achieved (equal to 10% of the deferred gain). Even better, if a QOF investor achieves a seven-year holding period by 12/31/26, this benefit is 15% instead of 10%. In addition, considering that this basis step-up occurs once the five- or seven-year holding period is achieved rather than only having effect on Dec. 31, 2026, if affected taxpayers were unable to deduct prior year losses due to a lack of at-risk tax basis, this basis step-up might accelerate the deductibility of suspended losses (if not otherwise limited by other loss limitation rules, such as for passive activity losses (§469), excess business losses (§461(l)) and net operating losses (§172(a)(2)(B))).

QOF investments with decreased value – For QOF investors whose fair market value of their QOF interest has decreased, there may be an opportunity for additional tax savings. Under Reg. §1.1400Z2(b)-1(e)(3), if the fair market value of the QOF interest (less certain basis adjustments) is less than the remaining deferred gain, this lesser amount may be able to be recognized in 2026 rather than the entire remaining deferred gain. This issue is nuanced, and more guidance from the IRS on this issue would be welcomed, but for taxpayers whose QOF interests have decreased in value, this may create an opportunity to further reduce the amount of deferred gain to be recognized in 2026.

What Changes Could Be Coming to QOZs Under Potential Upcoming Tax Reform?

Considering QOZs were a hallmark provision of the 2017 TCJA from Trump’s first term, many expect QOZs to be given new life under forthcoming tax legislation. Informed by recent proposals like the bipartisan Opportunity Zones Transparency Extension and Improvement Act (OZTEIA) in September 2023 and other recent proposals, the following is a partial list of potential upcoming changes to QOZs.

Extension of Dec. 31, 2026, deadlines to Dec. 31, 2028 – Proponents argue for a two-year extension due to a nearly two-year wait before final regulations were issued by the Treasury Department. COVID impacts are also cited as causing investment delays and justifying an extension.

Qualified feeder fund – This optional designation as called for by the OZTEIA would newly allow QOFs to invest in other QOFs.

Early sunset for high-income zones – Otherwise qualified census tracts with a median family income (MFI) at or above 130% of national MFI would become disqualified.

Reinstate and expand reporting requirements – Omitted at the eleventh hour from the TCJA in 2017, enhancements to current QOZ reporting requirements would allow more effective measurement of the law’s impacts.

Rural Opportunity Zones and Investment Act – Also stalled in late 2023, this proposal would:

Create new “rural OZs” in which capital gains could be reinvested until Dec. 31, 2032, a six-year extension relative to current law; and

Reinstate 10% and 15% tax basis adjustments for rural OZ investments held five and seven years, respectively

Other wish list items – QOZ advocates would also love to see more seismic changes like allowing QOZ investments to be made with after-tax dollars and making QOZs permanent. Assuming any QOZ tax bill would be subject to Congress’ budget reconciliation process, however, including changes this material may prove too costly.

Attempting to predict future tax legislation can be a fool’s errand, but one thing about the future of QOZs is safe to say: things should be quite interesting.

Sandy Klein, CPA, is a managing partner, New York with Katz, Sapper & Miller, Manhattan, N.Y.

Over half of Long Island towns vote to exceed the tax cap - Here’s how owners can respond - by Brad and Sean Cronin

Properly serving a lien law Section 59 Demand - by Bret McCabe

The strategy of co-op busting in commercial real estate - by Robert Khodadadian

How much power does the NYC mayor really have over real estate policy? - by Ron Cohen

.png)

.gif)

.jpg)

.gif)