2023 is behind us - by

Michael Packman

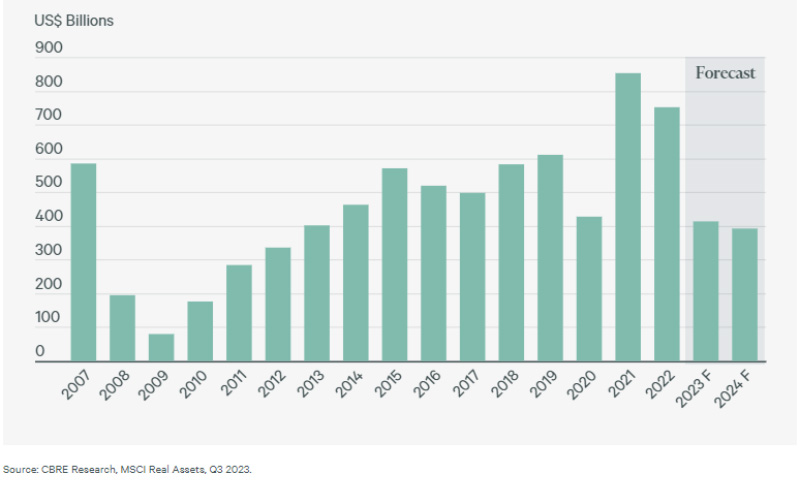

For commercial real estate investors, 2023 saw uncertainty between rising interest rates, worries of a deep recession as well as proposals from Washington D.C. to limit 1031 exchanges (again). These uncertainties have left investors that do not have to transact on the sidelines. Investors forced to sell due to loan maturities or a need for liquidity saw fewer buyers and, in many cases, lower than desired offer prices. The result, according to CBRE, was a 45% reduction in transaction volume from 2022.

Even though news headlines in 2023 pointed to steep price reductions of as much as 40% for office in major central business districts, MSCI reports show an aggregate of only 20% declines in office nationwide and lower declines in other sectors such as multifamily and retail with self-storage and certain types of industrial and hospitality holding their value throughout the year.

MSCI further notes that the largest drop in transaction volume from 2022 was a 61% reduction in multifamily transactions1. As a percentage of total volume, the reduction in volume was like the reduction in volume that occurred between 2008 and 2009. Yet the price adjustments do not appear to be as significant as 14 years ago. The sharp increase in interest rates caused by the Fed’s actions did not trigger the distressed sales that investors may have anticipated. Arguably the factors that may have attributed to this include stricter loan underwriting, higher debt coverage ratios and the fact that the real GDP growth for 2023 was approximately 2.5% based on the Advance Estimate for 2023Q4 despite the increase in rates.

More Uncertainty for Real Estate in 2024

There are plenty of reasons to look at 2024 with optimism. Not only did the Fed pause interest rate hikes in 2023 (as I discussed here in November), but the Fed has also signaled the likelihood for interest rate cuts in 2024. Based on the 2023 GDP estimates, the so-called “soft landing” may be reality and the US economy may avoid a recession; for now.

However, there is still dislocation between buyer and seller price expectations in most asset classes. Although the 10-year Treasury is lower than its recent peak of 4.98% in mid-October, as of January 25, 2024, it is still up sixty-three basis points from a year ago and there are macro-economic factors that continue to cause volatility in the treasuries, which causes uncertainty with loan interest rates and therefore pricing.

Add to that, 2024 is a presidential election year in the United States. Without diving into politics, a study by Nationwide in October 2023 found that “nearly one in three [regardless of party affiliation] believe the economy will plunge into a recession if the party they don’t support wins”2. If that becomes reality, it could have a negative impact on commercial property incomes for properties that do not have high-quality tenants with long-term leases and adversely affect values across the board.

Long Term View

Commercial real estate investors that have been investing for any length of time know that real estate values are cyclical. This is why many successful real estate investors have a long-term investment horizon. Over a period of seven to ten years, there are going to be fluctuations in valuation caused by unpredictable factors. Presuming an investor performed their deal-specific due diligence and underwriting, a patient investor has a much better chance to successfully weather the broader market uncertainties.

This year will be an interesting one. There may be sellers who receive lower offers than they would like and buyers that may feel they are still overpaying due to all the uncertainty. If you do decide to buy property this year, sticking to the fundamentals of acquiring properties in good locations, and with good tenants and taking a long-term investment horizon approach, hopefully you can mitigate some of the risk.

1. https://www.globest.com/2024/01/26/theres-a-reason-why-2023-felt-like-the-global-financial-crisis/

2. https://news.nationwide.com/101123-nearly-half-of-investors-believe-2024-election-will-have-a-big-impact-on-portfolios/

Michael Packman is founder and CEO of Keystone National Properties (KNPRE), New York, N.Y.

Over half of Long Island towns vote to exceed the tax cap - Here’s how owners can respond - by Brad and Sean Cronin

The strategy of co-op busting in commercial real estate - by Robert Khodadadian

Oldies but goodies: The value of long-term ownership in rent-stabilized assets - by Shallini Mehra

How much power does the NYC mayor really have over real estate policy? - by Ron Cohen

.png)

.gif)

.jpg)

.gif)